Coinflation Silver

Silver $26.97 (+0.60) 02-05 4:59 PM EST PCGS3000 ® The PCGS3000 ® reflects the opinions of PCGS’s coin price experts with respect to indexes developed by PCGS for specific coin categories. Coinflation keeps a running total of U.S. And Canadian coin melt values calculated from the actual market values of the precious metals and bullion in them. They track current coins as well as older coins, so you can look up your Morgan Dollars, too. Jefferson Nickel, Wartime Silver Alloy (1942-1945) 56% Copper, 35% Silver, 9% Manganese: 5: 0.0563 $1.52: Barber Dime (1892-1916) 90% Silver: 2.5: 0.0723. Live 24-hour Silver Price Spot Chart from New York, London, Hong Kong and Sydney. Silver Prices Updated Every Minute. (Newport Beach, California) - Coinflation.com (www.Coinflation.com), an increasingly popular informational website that provides the values of precious metals and the intrinsic values of gold, silver and base metal coins, has been acquired by Collectors Universe, Inc. (NASDAQ: CLCT), the parent company of Professional Coin Grading Service (www.PCGS.com).

- Coinflation Coin Silver Calculator

- Coinflation Silver Coin Calculator Coins

- Coinflation Silver Melt Calculator

What is coinflation? Coinflation, as a definition, is a term that was “coined” from the idea that the metal used to make coins would appreciate in value over time due to inflation. Coinflation is the word “coin” and the word “inflation” combined together to form the word coinflation.

The word is actually made up by the original owner of the website coinflation.com. The owner sold the website several years ago. The originator of the word stated they would define it as:

noun. 1. A persistent rise in the metal value of silver and base metal coins. 2. An inflationary effect on coins. 3. The difference between the metal value and face value in coins.

The premise being the trend of the value of metals over a long enough timeline is most upward. The value of currencies over that same timeline is downward. One could derive that inflation has created an inverse relationship between currency and metal value. The results is the value of coins to rise over time in intrinsic metal value.

Silver Coinflation Value

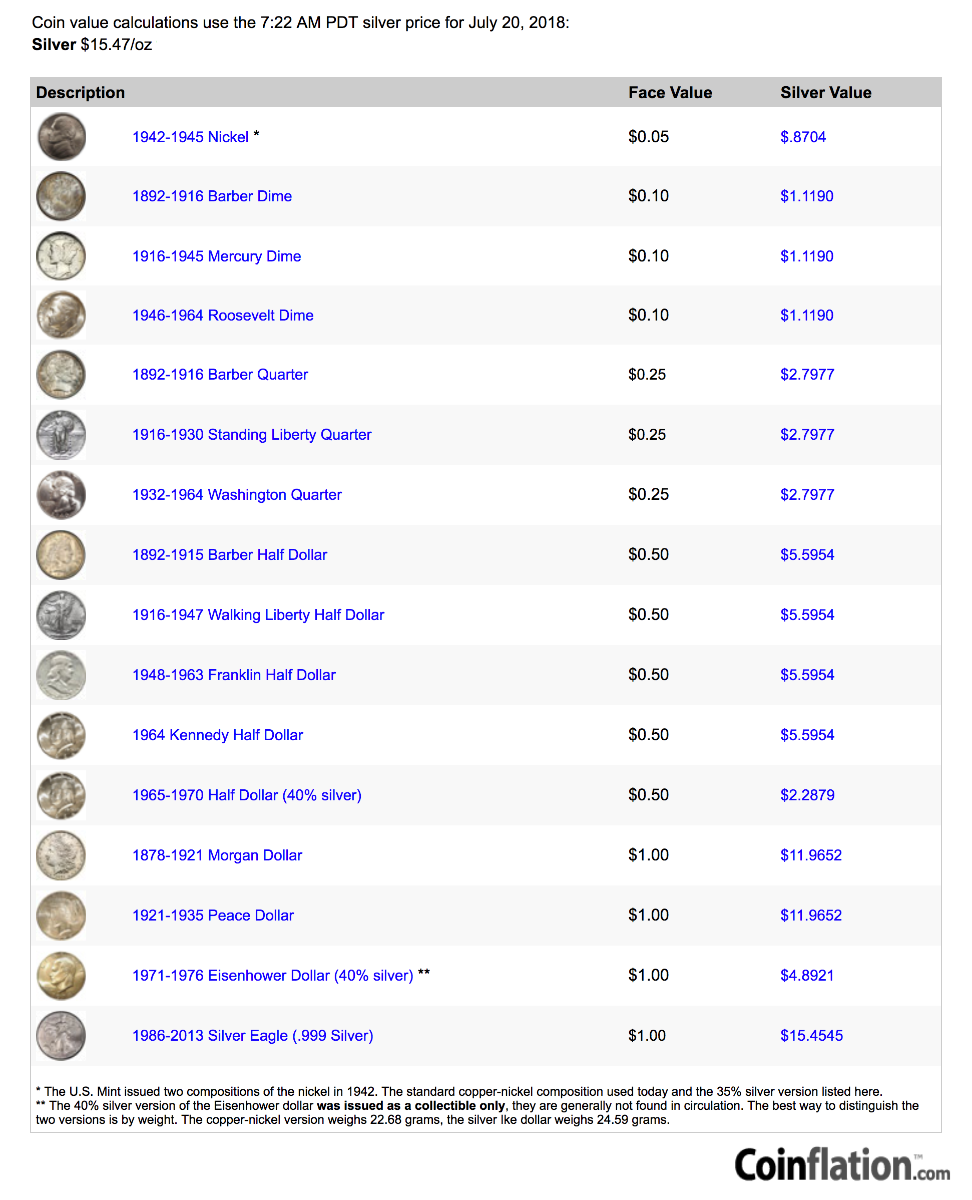

The best example of what coinflation means and how it works is to think back to the coins in the United States that were made of silver such as dimes, quarters, and halves. The metal composition for these coins was 90% silver and 10% copper.

Coinflation Coin Silver Calculator

The last year the silver dime and quarter were minted was 1964. Silver halves were 1970 at 90% silver. Halves were only 40% silver between 1965 to 1970). The return on investment from a percentage standpoint, the inflationary coinflation value of silver in a silver dime compared to its face value has been anywhere from 1,000% to 2,000% and more in recent years.

Coinflation Silver Coin Calculator Coins

If you simply kept your dimes from the 1960s and left them in a drawer for 50 years, every $1 you had would now be worth $10 to $20!

People spend so much effort and time on finding the perfect investment. Very little time has been spent on understanding the impacts of inflation has on currency and metals.

The above chart helps to show the devaluing of the United States dollar over time since the inception of the third, and current, Federal Reserve.

Coinflation Silver Melt Calculator

Coin Melt Value Calculator

Coinflation App

The Coinflation website developed an app. Furthermore, the app can be found here:

Customers care about the value of their coin. In addition, the calculators show this value. Furthermore, the calculators updates frequently based upon real metal prices. Because the calculators updates frequently, it has become a reliable source.

Coinflation.com Metals (copper/silver)

Coinflation.com predominately shows copper and silver prices. In addition, the site shows nickel and zinc too.

Coinflation.com Collectors Universe Update

The owner of coinflation.com is Collectors Universe. Collectors Universe did not originally create it. The website was last updated in 2014. As a result, users must be aware of any potential coin composition changes that may have occurred since 2014. Furthermore, advertising income has become the dominant purpose of the website.